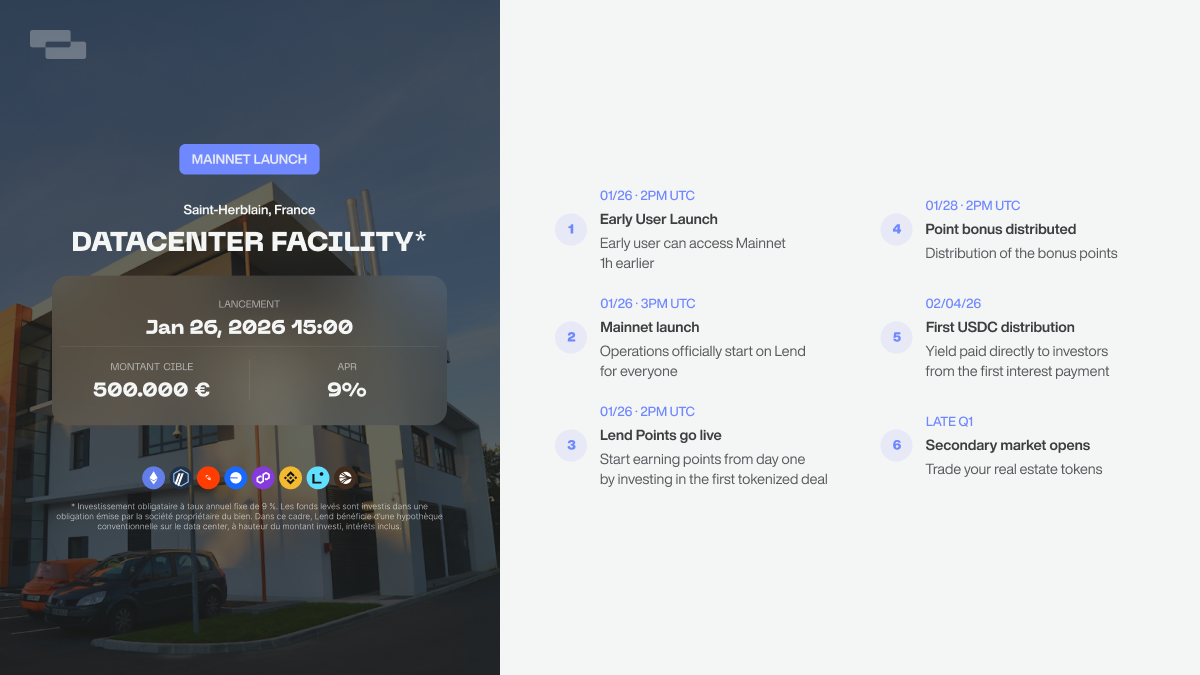

We're excited to announce that Lend's inaugural tokenized real estate operation is officially launching on January 26, 2026.

After months of building, testing, and preparing, we're ready to offer our community access to institutional-grade real estate yields starting with a data center in Saint-Herblain, France.

You can now review full documentation and financial breakdowns here: https://app.lend.xyz/operation/datacenter-facility-saint-herblain

Lend’s first operation

Total operation size: €500,000, approximately 580,000 USDC

Minimum participation: 10 USDC

Launch date: Monday January 26th at 14:00 UTC

Asset: Data center (commercial property)

Location: Saint-Herblain, Nantes Metropolitan Area

APR: 9% fixed, renewable annually

Minimum Investment: 10 USDC

This is a fully operational data center that's been generating consistent revenue since 2008, leased to the same commercial tenant for over 15 years.

The tenant has just signed a new 9-year lease, effective in 2024, which locks in €600,000 in annual rent.

👉🏻 Roadmap:

Early User Launch

01/26 · 2pm UTC

Early user can access Mainnet 1h earlier

Mainnet Launch

01/26 · 3pm UTC

Operations officially start on Lend for everyone

Lend Points go live

01/26 · 2pm UTC

Start earning points from day one by investing in the first tokenized deal

Point bonus distributed

01/28 · 2pm UTC

Distribution of the bonus points

First USDC distribution

02/04/26

Yield paid directly to investors from the first interest payment

Secondary market opens

Late Q1

Trade your real estate tokens

The underlying asset

The financed asset is a commercial data center located in Saint Herblain, within the Nantes metropolitan area.

The site has been fully operational since 2008.

It has been occupied by the same tenant for more than 15 years.

A new commercial lease signed in 2024 secures occupancy for 9 additional years, with indexed rent and long term visibility.

The building includes 3,124 m² of operational space and 47 parking spaces.

Annual rent currently amounts to €600,000.

The underlying property value is estimated at approximately €5.5M.

The asset is located near Nantes, in a dynamic economic area benefiting from a strong technology ecosystem and sustained demand for digital infrastructure.

Investment structure

This operation is a fixed income bond investment offering a 9% annual yield, fully predefined and contractual.

Up to €500,000, approximately 580,000 USDC, will be invested in a bond issued by the asset owning company, SAS Isabelle.

In this context, Lend benefits from a conventional mortgage on the data center, up to the invested amount, including interest.

The return does not depend on the operational performance of the building.

It depends on the proper execution of the underlying bond.

The bonds are issued as tokenized financial securities.

Subscriptions and repayments are made in USDC.

Key terms

Fundraising target: Up to €500,000

Annual yield: 9% fixed

Initial duration: 1 year

Renewal: Possible annually up to 5 years, subject to approval by SAS Isabelle and then by investors

Payout frequency: Weekly

Instrument: Tokenized bonds, security tokens

Funding date: 01/26/2026

First income distribution: 02/04/2026

Structure: Tokenized bonds secured by a 12.5% first-rank mortgage (€687,500 in collateral)

Fees: Fully transparent. Lend charges €32,500 (paid by the property owner, not you). No hidden management fees, no acquisition costs, no "performance fees" eating into your returns.

Fully Regulated, Fully Onchain

All operations on Lend is compliant:

- AMF-regulated structure in France

- Registered securities (tokenized bonds)

- Legal documentation available to all investors

This is what proper tokenized real estate looks like.